Groups of similar investment types are called asset classes. Bonds are one of the main asset classes, and they are typically present in most investors’ portfolios to provide some fixed income. Since bonds provide a stable return, they can offset some of the risk from stock investments.

What are Bonds?

When institutions like the government or a corporation would like to raise an amount of money, they borrow money by issuing bonds. These bonds can be bought by investors, and the price of the bond is loaned to the institution.

In this way, bonds are like an IOU: the borrowing company acknowledges the amount that has been given to them by the investor, and promises repayment with interest. The interest is generated at regular intervals, depending on the details of the bond, and the principal is paid in full at the end.

It is also possible to sell bonds on the market, meaning that a person does not need to see the bond to maturity. This makes the bond susceptible to supply and demand forces of the market, and the bond’s price may change in accordance with competing interest rates.

Since bonds have a stable interest payout and the original amount is repaid, they are considered a safe investment. The major risk with bonds is the threat of the borrower defaulting – that is, when the bond-issuer cannot repay the amount.

However, choosing the right bond can help mitigate the risk of default. There are many factors to consider when investing in bonds, from interest rates to date of maturity, which is when the final payment is due and the bond is closed. Here are the three basic things to know before investing in bonds:

1) Bond Yields

The bond yield is the return that a bondholder receives. Owing to the fact that bond prices are determined by market forces, the yield can be calculated with different formulas.

The fixed rate of interest that the bond-issuer borrows money at is known as the coupon rate or nominal rate. This rate remains unchanged in the face of market fluctuations. The interest can then be derived from a simple formula, as follows:

Annual yield = Bond price x Coupon rate

This formula assumes that the price of the bond is the price at which it was issued, which is called its face value. But it is possible to buy bonds in the market at a price higher (premium) or lower (discount) than the face value. This changes the yield derived.

This is because the price of the bond varies based on interest rates of other bonds. If other bonds offer a higher coupon rate, investors are attracted to it; and if they are lower than our bond, investors are driven to our bond. For example, if our bond has a 5% coupon rate, and other bonds are at 10%, the market value of our bond falls. But if other bonds are at 3%, our bond is more attractive.

The price of the bond is hence adjusted so that the interest earned is higher. That is, using the above formula, we can see that lowering the bond price makes the coupon rate higher because the coupon rate is equal to the annual yield divided by the price the bond was bought at (not the face value), as follows:

Coupon rate = Annual yield/Bond price

The yield to maturity (YTM) is the most commonly used measure used to judge the return on a bond. It is the expected annual return of a bond assuming that the bond is held to maturity and all interest payouts are made on time. The formula for YTM is more complex than that of simple yield, as follows. It can easily be derived using a financial calculator.

2) Bond Ratings

As mentioned earlier, bonds are usually a safe investment but their biggest risk is when the borrower defaults, and is unable to pay the sum back. The good news is that this risk can be reduced by knowing the credit rating of the borrower.

A rating of credit quality is basically a score or grade given to an institution based on how likely they are to repay their loans. A good rating means it is usually safe to invest in such bonds, but bad ratings means that default is more likely.

Most institutions with bad ratings usually offer higher coupon rates to lure more potential bondholders. Hence one should always consult bond rating pages before investing in lucrative deals.

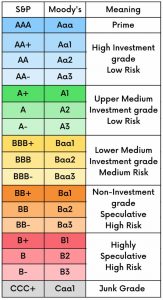

There are many credit rating services available for the very purpose of helping you choose a bond that guarantees a payout. “Investment grade” bonds are exactly what it sounds like: they are mostly safe to invest in, whereas risky bonds are called “junk grade” or “speculative bonds”.

Each rating agency provides are more detailed breakdown of these two categories. The most popular and trusted agencies and their ratings are briefly detailed below.

Bonds rated C or D on both scales are at extreme risk of default. In general, the safest bonds are rated double A or above, as shown in blue in the table.

3) Bond Screener

Finally, choosing a bond to invest in can involve a lot of other personal factors, such as the particular year of maturity – perhaps you would like it to coincide with your child’s graduation or your retirement. Perhaps you would like a bond that has payouts quarterly rather than semi-annually (which is the typical frequency at which borrowers dispense payments).

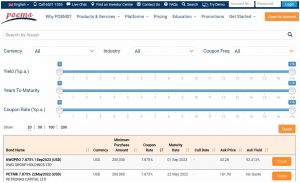

Bond screeners are especially useful when you have specific requirements. The POEMS bond screener uses effective filters to narrow search results among hundreds of available bonds to find those that suit your investing strategy.

As seen in the above picture, the bonds can be tracked across many different variables. Similar to the advanced search tools on Google, it is possible to use the dropdown menus to adjust the search parameters: such as currency, industry and frequency of payout. The sliding scale can be used to set a range for the yield percent, year of maturity and coupon rate.

And if, even after setting these parameters, the search is still quite vast, the arrow symbols in each column header can be used to sort the results in ascending or descending order. The bond price and the market ask price is displayed for a better understanding of the value of the bond.

By analyzing all these criteria and researching the credit rating of the bond issuer, you can now choose the bond that will provide a cushion income for your investments.

Conclusion

In summary, bonds are issued by a company to raise funds, and individual investors can purchase them. These bonds function as a loan from the bondholder to the company, and the bondholder earns stable interest.

However, unlike loans, bonds are subject to market forces that are swayed by prevailing interest rates. Thus, bond yields can be calculated differently.

Moreover, some bonds are riskier than other bonds because some companies cannot pay back their loans. This risk can be lowered by choosing bonds by issuers that have been rated highly by trusted services such as Moody’s or S&P’s.

Other factors that must be taken into account are year to maturity, coupon rates, and market values. These can all be input to a bond screener and we can then choose the best bond to suit our needs.

20 Comments

Thanks for the information. Hopefully, I can use this information in the near future. Great work.

https://www.rocklandmover.com/

our drywall specialists also have bonds like this.

Glad to check this informative article here. https://hebrews34.com/

Thank you for always keeping us here posted. Website

Interesting post! https://www.provobathtubrefinishing.com/

Thank you for always sharing here an informative post. oilbuddy.net/

Awesome post! info

Nice post! Thanks for the share. https://www.radroofingaz.net/

Would love to check this site more often now. https://www.crseptic.com/

It’s nice seeing here the informative content. click here

Looking forward to seeing more posts from this site. carpetmasteronline.com//

Thank you for keeping us here updated with new posts. apexpowerandlight.com/

Nice post! Great content you shared here. info

Glad to check this site, great article indeed. https://www.preciseintelpi.com/

Would love to see more interesting posts here. https://www.aceheatingandairtexas.com/

Great to see an informative article here. visit us

Great data to learn! Thank you. https://www.lashscouts.com

This is our topic at Atlanta yesterday. The rate remains unchanged in the face of market fluctuations, i think.

Definitely imagine what you said. Your favorite reason appeared to be on the web the easiest thing to be mindful of. Anyway, have you guys heard about Interior Painting Regina? Check their site.

It’s nice seeing this great article here. website