Do you know that at 4% per annum interest rate, your CPF Special Account (SA) current balance will double every 18 years thereabouts?

Do you also know that there’s a CPF Contribution Cap? That’s right. Only the “first” $6,000 of your monthly salary is subject to CPF contributions. Even if you earn a basic salary of $200,000 per month, your CPF contributions are calculated based on just $6,000. Try using the official CPF Calculator to see for yourself.

What about bonuses? Good question. Bonuses are considered “additional wages” and are subject to CPF contributions. However, there is also a cap called the Additional Wage Ceiling. The details are available here, but generally the combined Ordinary Wage and Additional Wage that are subject to CPF cannot exceed $102k per year. If you make $6k basic monthly and receive a $100k bonus at year end, only $30k of the bonus will be subject to CPF contributions (because 102 – 6×12 = 30).

So how much money do you have in your CPF Special Account?

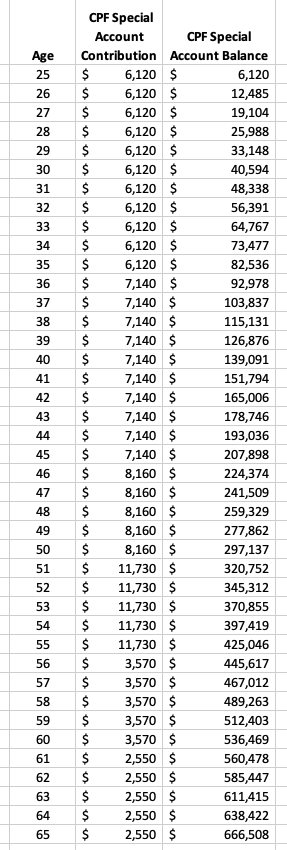

Compare your CPF Special Account (SA) balance with that of the hypothetical guy who has been very lucky to be earning above the contribution cap his whole life and also receiving $30k bonuses every single year. See the chart below.

When he’s 50 years old, he has amassed almost $300k in his CPF SA account.

And due to the higher contribution rate from age 51 to 55, he will have more than half a million before reaching 60!

The calculation below takes into account the annual 4% compounding interest that CPF pays into his SA account (but it does not consider the overflow effect of a “full” Medisave Account).

42 Comments

Very informative and detailed. Thank you for this. | https://augustatreepros.com

Very informative and detailed. Thank you for this. | https://augustatreepros.com

Cpfs are very important for fresh graduates. concretesantabarbara.com/

Nice.

Thanks for enlightening us! The chart and the formula are very precise that anybody like a drywall expert like me can easily understand.

Great Article it really informative and innovative keep us posted with new updates. It was really valuable to Sheetrock Repair near Fort Worth, Tx. thanks a lot.

You have good information! Keep it up. Thank you online-application.org/social-security-administration-office/

Thank you for explaining this topic about CPF Special Account (SA). I could use this for our UTV Rental computation.

Very good information.

Allen’s Tree Works

Thanks for this great share. ogdenbathtubrefinishing.com/

Wew, this is so informative. Thanks https://online-application.org/social-security-administration-office/

Indeed, God loves me. He allows me to see this information that will help me with my decisions in the future.

This is a great resource for masses with intermediate knowledge of finance. Thanks for sharing. Regards, Glasgow Tree Surgeons and Arborists.

As Caxino online website become more well-known, many trustworthy businesses are now making investments in them to guarantee that players have a satisfying gaming experience.

It’s nice seeing this great content here. https://www.ismilespa.com/

Great work! Keep it up. getshinedetail.com/

I’m so impressed with your details! Thanks http://www.change-of-address-form-online.com

Thanks for posting this here. https://www.jrfloreslandscape.com/

This is great! Thanks for sharing. info

Such a great stuff, thanks for the share. website

What an awesome and cool post. Thanks for sharing! residential trash pickup Bridgewater MA

This post is one of the best posts according to my point of view. Your work is so good and impressive. Thanks for it click https://franzrepro.com/

A great day and a piece of very explicit information. precio panel sandwich

And due to the higher contribution rate from age 51 to 55, he will have more than half a million before reaching 60! Greetings from best drywall company in Pasadena!

Hope to get some info on your blog in the future. – Electrical Prince George

Thanks for the blog loaded with so many information. find ebay offer

Woah! this is so informative. Thanks Augusta Capital Partners

Thanks a lot for sharing all of this useful information with us! I will be sure to share it with the people from my favorite roofing company in Jacksonville Worthmann Roofing

Amazing! Thank you for sharing the CPF Calculator with us!

Regards,

Jimmy | fence expert

The information you’ve shared relates to the Central Provident Fund (CPF) in Singapore, a comprehensive social security system that includes retirement savings, healthcare, and housing benefits. mason

Yes, I am aware that at a 4% per annum interest rate, your CPF Special Account (SA) current balance will double every 18 years thereabouts. This is because of the power of compound interest. Compound interest is when you earn interest on your interest, which can help your savings grow exponentially over time.

Security fencing

If you make $6k basic monthly at https://www.drywallarlington and receive a $100k bonus at year-end, only $30k of the bonus will be subject to CPF contributions (because 102 – 6×12 = 30).

In accordance with CPF contributions, bonuses are regarded as “additional wages.” | brisbane

Bonuses—what about them? Nice query. Bonuses are regarded as “extra wages” and are covered by CPF contributions. Nonetheless, an additional ceiling known as the Additional Wage Ceiling exists. Need assistance? call us!

Awesome post! Thanks for the informative content you shared. https://www.germantowntreeexperts.com/

This is a great comparison for the Best drywall company in Wilmington. Thanks for the heads up!

A sturdy roof shields occupants and their possessions from the weather while also preserving the structural integrity of buildings. See: roofing whangarei

A sturdy roof shields occupants and their possessions from the weather while also preserving the structural integrity of buildings. | concrete driveway pittsburgh

This is an awesome post. Thanks for the share. brazilian jiu jitsu classes

It seems like you’re interested in understanding how CPF (Central Provident Fund) contributions and interest rates affect savings in the CPF Special Account (SA). our location

You’ve got some interesting points about CPF savings! Gulf Coast Panana Jack Beach Products

This highlights the importance of understanding CPF contribution rules and taking advantage of the compounding interest within the CPF system for long-term financial planning and retirement savings. https://www.themyndclinic.com/