To some Singaporeans, budgeting can be an inconvenience.

Not only do you have to plan out how much to allocate for various types of expenditures – necessities and wants – you’ll also have to track your spending.

As life in Singapore is already fast-paced, that can be seen as a “chore” to an already full plate.

There will be some who don’t see a need. And that can be a cause for concern.

In proper money management, budgeting is one of the very first things you can do, and it greatly impacts the amount of savings you’re left with at the end of the month.

Ultimately, with more savings and you making use of your money, you’re able to grow your net worth at a faster pace.

So, let’s dive deeper into this topic!

The Government Budgets Every Year

The Singapore government, without fail, announces its budget every single year.

It includes what they are going to spend on and how much would be allocated to those expenditures.

As a recap of Budget 2021, the theme is “emerging stronger together”. During the pandemic, businesses and the economy took a hit. Now in 2021, there are signs of recovery, and the government is trying its best to pull Singapore away from the downturn. Therefore, proper injection of money is critical to the full recovery of the country.

In essence, budgeting has a positive impact and that’s why the government does it every year.

Do Singaporeans Budget Their Spending?

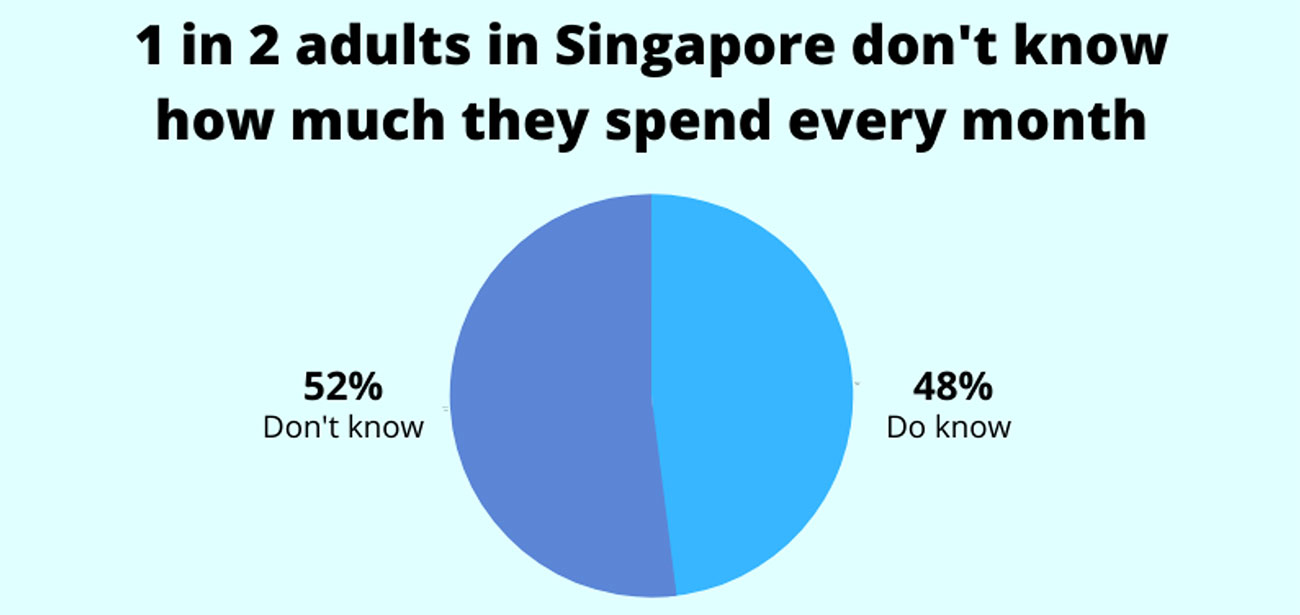

According to a survey of 984 adults in Singapore, conducted by SmartWealth, 52% of respondents don’t even know how much they spend every month.

How would they even be able to budget?

And that’s worrying.

And that’s worrying.

Without knowing how much you spend, you’ll never know whether you’ve already overspent or not.

That could lead to potential financial problems such as having little to no savings left. And if that continues for an extended period, you might not be able to achieve your future financial goals (e.g retirement).

So what can you do?

3 Things You Can Do to Improve Your Finances

Knowledge is nothing without action.

You can read many investment books, but if you don’t start dipping your feet into investments, you won’t be able to grow your assets.

Same thing with personal finance.

If you don’t start doing something about your spending habits, you’ll not be able to save more.

Here are 3 actionable tips:

1) Budget your spending

From your salary, decide how much should go into savings, necessities, and wants.

You can use a simple budgeting rule such as the 50/30/20 rule (50% for necessities; 30% for wants; 20% for savings).

As everyone is different, you can always tweak this rule to your unique situation. If you want to save more, simply allocate more into savings.

By deciding how much you can spend, you’re creating a limit. Throughout the month, when you know you’re reaching that limit, adjust accordingly.

2) Pay yourself first

In most cases, when people receive their salaries, they tend to spend first and then save later (if there’s anything left to save).

That’s not the optimal way to save money.

We should flip that equation – save first, then spend later.

How this works: when your salary comes in, transfer the amount you’ve budgeted to save into another savings account. To create greater enforcement, make it tough to withdraw and spend these savings.

That way, you’ll always have savings at the end of the day.

3) Track your spending

By transferring out your intended savings, what you’d have left is the amount intended for expenses – necessities and wants.

Make it a point to depend solely on this amount.

If you’re the type that lacks the discipline (e.g spending frivolously), you might want to pay closer attention to your spending by tracking individual expenses. That way, you’d always know how much you’ve spent that month and how much you’re left with.

This is a crucial element because you’re constantly aware of it.

There are 3 main ways to track your spending: using an app, an excel spreadsheet, and an online budget/expense calculator.

Why is this important?

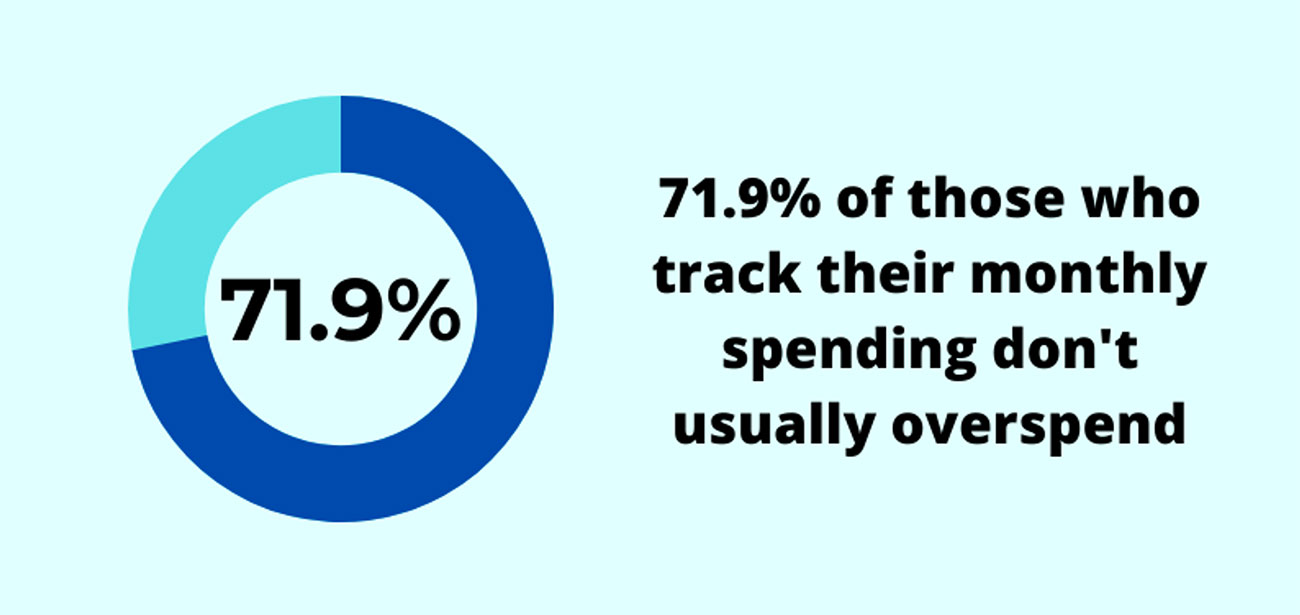

In the same survey that SmartWealth has done, 71.9% of respondents who do track their monthly spending don’t usually overspend.

And that shows the importance of knowing your numbers.

And that shows the importance of knowing your numbers.

Conclusion

Spending (or overspending) applies to everyone – savvy or not.

And it’s totally within your control.

When you budget your spending and stick to the limits you’ve set yourself, you’re able to consistently save a portion of your salary every month.

With that, you can then either create an emergency fund or make better use of it by investing (depending on your risk appetite).

Ultimately, it helps you grow your wealth so that you have much more to enjoy in the future.

1 Comment

Using an Excel spreadsheet to track your expenses offers several benefits that make it an important and popular choice for managing your personal finances. Excel provides a high level of customization, allowing you to design your expense tracking sheet exactly how you want it. You can create categories that match your spending habits, set up formulas to calculate totals, and create charts to visualize your spending over time. This is especially useful for students who want to learn Excel in more detail, perhaps even if they have a do my excel homework assignment. Building and maintaining a budget spreadsheet in Excel provides an opportunity to improve Excel skills. You can learn how to use functions, formulas, conditional formatting, and other features that can be useful in various aspects of your personal and professional life.