Globally, there are upwards of 13.9 million traders online. They’re busy plying their trades across the forex, stock, commodities, and futures markets, to name a few. Each investor enters the fray with different aims, timelines, capital, and understanding of the markets they want to invest in. Some might not have even got that far.

There’s not what we might call a ‘right way’ to invest money. In fact, any literature which claims to have that answer probably shouldn’t be trusted all that much. Instead, trading is more like writing a book or building a house. It takes time, you need patience, commitment, and an action plan. Without a doubt, the tools you use will be critical. Serving those millions of traders are a veritable host of different platforms, as covered by the Financial Times, all focusing on the different needs of retail and institutional traders. Finding the right platform for you is as much about where you’re at now, as it is about where you’re hoping to be within months, or several years, time.

Fail To Prepare

Doing your homework is more than just a phrase. Warren Buffet’s Berkshire Hathaway was built doing the legwork and understanding the fundamentals of unloved stocks that others overlooked. Before you even start picking out assets you think you want to invest in, pinning down the basics of language is very valuable to you, and can mean being more effective at absorbing news and developments with more efficiency in the future. If education is top of your list, you want a platform with a rich library of support material and educational resources available ideally with low or no fees. There are several options here, including the likes of regulated services like Infinox, renowned wikis such as Investopedia, or educational platforms like Udemy who offer substantial guidance you can use to build a base of knowledge.

The Difference A Day Makes

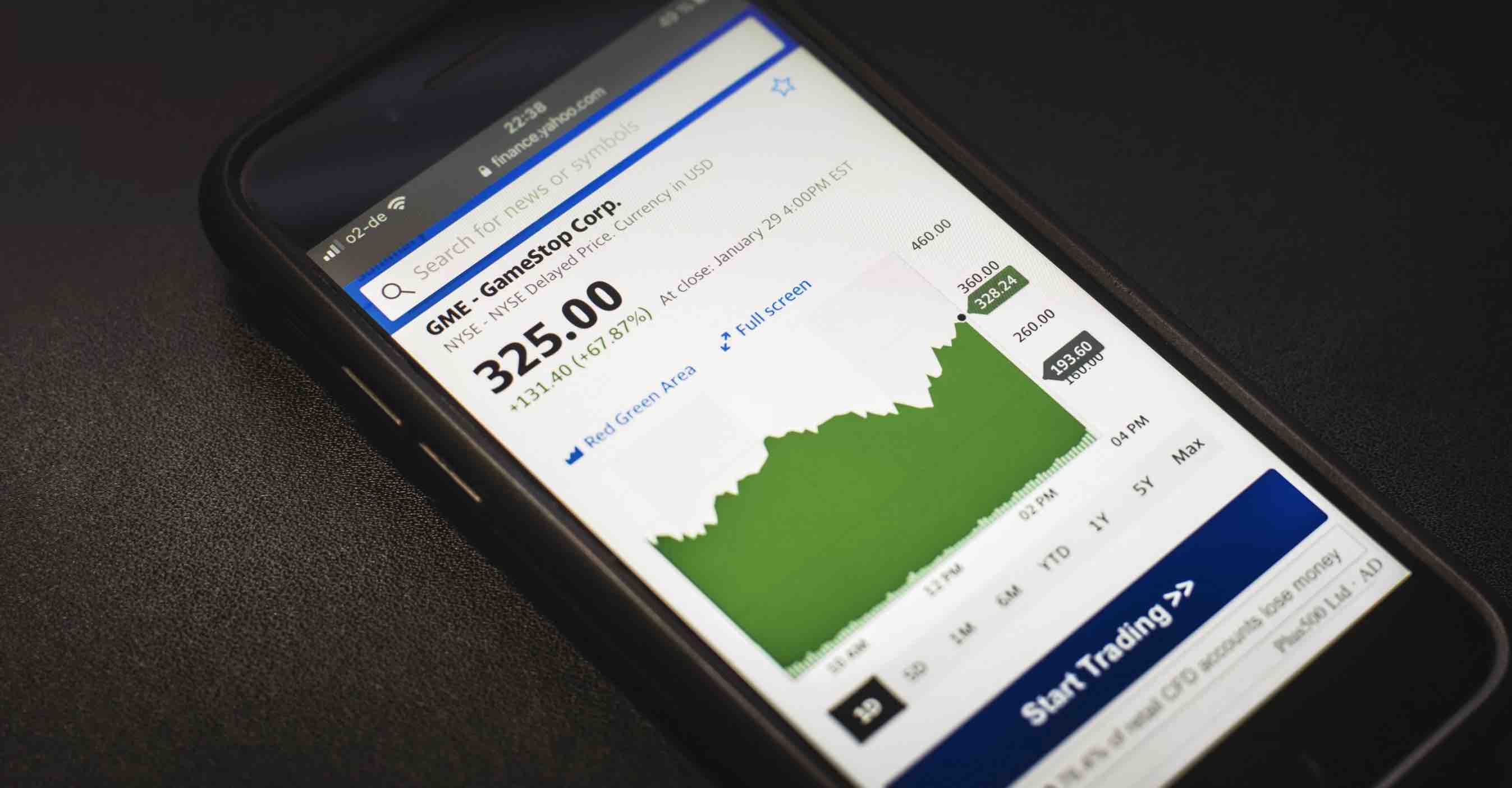

You’ll find numerous terms for the different types of traders as covered in-depth on Investopedia, but the most common are scalping, day, swing, and position traders. Each will focus their trades over a different rough time period. Scalping can be incredibly quick, over minutes or seconds between trades. Day traders are common, spending 24 hours making their decisions. Swing and position traders are more long-term focused, and can even move over months or more as part of their speculation on assets. None is necessarily more effective than another, but it’s good to look for both markets and platforms that suit your needs.

If you’re trading alongside a day job, your time commitment will be much smaller, and so you might want to look at some Robo-advisors or actively-managed accounts that offer you some control over the direction of your investments but can handle the heavier lifting for you. Alternatively, if you’re willing to put the time in and want the flexibility to trade whenever you like, forex markets offer 24-hour, five days a week access to trading. Others, like stocks, will close every day and remain entirely shut over weekends.

Practice Makes Perfect

The final feature that can make any trader’s life that much easier is being able to use a practice account. With plenty of fake money to play with, a sandbox practice account lets you both get to grips with the platform in action, and the behavior of the markets. You can observe how trade executions work on a specific platform and the omnichannel quality of mobile and web apps in comparison. These are all worth researching before paying a fee to open an account.

Alongside those aspects, features like customer service or additional tools can be majorly important for some users, and less so for others. Common advice for any trader entering the world for the first time is to never follow a trend or chase gains. Rather, the best thing to do is make decisions based on your own knowledge and your own strategy. The same due diligence should apply to the platform you choose to work with.

1 Comment

Pingback: Picking The Right Trading Platform For You | TheFinance.sg