The latest advancements in technology have brought ease and convenience to international money transfers. These days, expats can remit funds to virtually any part of the world with just a few clicks of a button, unlike in the past when it would take several weeks for the recipient to be credited. Nonetheless, international money transfer doesn’t come without a few challenges. Let’s explore a few common mistakes expats make when transferring money overseas.

1. Not Comparing the Exchange Rates and Fees

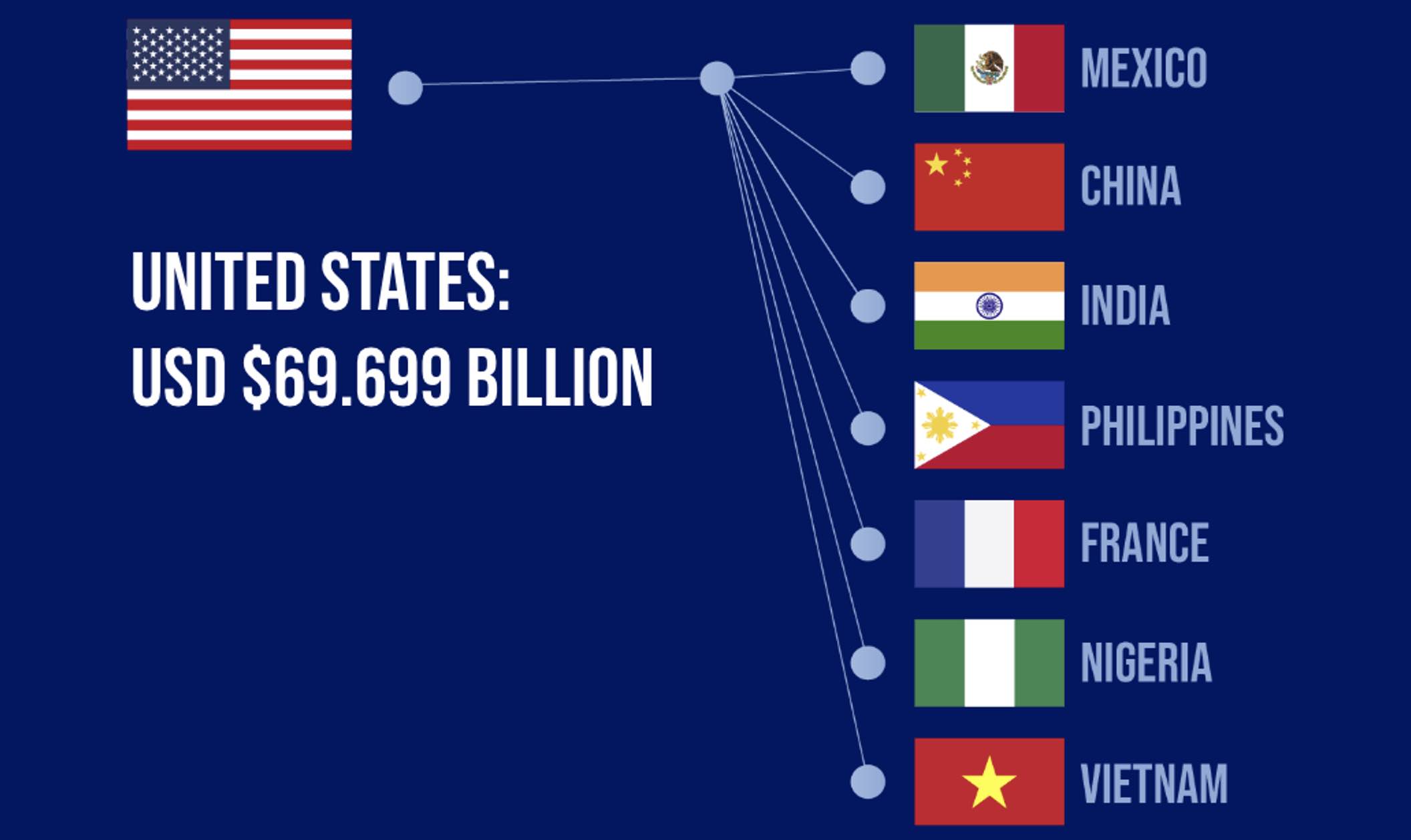

Wire transfer providers charge varied fees and different exchange rates. In most cases, the charges will depend on your country of residence, where you are sending the money and the currencies of the two countries. Americans are the largest sender of money overseas, sending billions to various countries shown in the image created by comparethemarket.com.au below. This is why it is important to double check their exchange rates to ensure they know exactly how much it will cost to transfer, especially if recipients are in multiple countries. At the end of the day, wire transfer providers are out to make a profit from each transfer they execute.

As an expat, it pays to shop around and compare the fees of sending money from different service providers so you do not pay more for a service that you could have otherwise spent less. Also, try comparing the fees charged by banks versus other providers.

2. Wrong Calculation of Delivery Time

Different transfers take different amounts of time to be received by the recipient. For instance, in nonbank wire transfers, paying with a debit card speeds the rate at which the money will be sent and received. Also, there are several transaction options when sending money abroad, including express and slow delivery. You can choose from the two depending on the urgency of the transfer. Don’t forget to consider weekends and holidays, which affect the delivery date.

3. Inexact Account Details

A blunder of a finger can cause tremendous problems while transacting money remission overseas. Supplying the wrong account details can put you in a tight and nerve-wracking corner. Considering the slim chances of recovering your money, it can drive you crazy. To wire your money, the service provider requires complete bank details, addresses, your transit number, and those of the recipient. This is where confusion and mistakes come in if you are not careful.

Note that, the routing numbers and accounts which jointly pinpoint the bank account on both ends have different arrangements in different countries. If you feed fewer or more digits or switch the account routing number, your money can easily land into a strange account.

4. Currency Conversion Issues

While wiring money to any country, you expect that money to be converted into a different currency once it gets to its destination. For instance, if you are sending cash from your rupee account in India, to a dollar account in the USA, it will have to be converted before reaching the recipient.

If you forget to convert it on your side, the receiving bank can reject the transaction. In some cases, if your foreign bank happens to convert your money, it may attract a higher exchange rate. This will have a ripple effect, and your recipient will end up getting fewer funds than they expected.

If you ask many expats, wire transfer is probably one of the best things the 21st century has offered. It is an easy and dependable way to send cash electronically to a recipient hundreds or thousands of miles away. However, wiring money is only convenient if you know how to avoid errors and mistakes while doing so.

Mistakes can be quite expensive, considering that wire transfers are almost irretrievable. In case you make a mistake, get in touch with your bank immediately for a solution. All the same, you now know what to avoid the next time you are remitting funds back home as an expat.

1 Comment

I never thought of comparing currencies before. Thank you for this information.

Santa Maria Electrician