If you haven’t jumped on the crypto bandwagon yet, don’t worry, because it’s here to stay so you’ve got plenty of time.

Typically, one has to sign up for a ‘wallet’ and go through a stringent verification process in order to trade crypto on an exchange.

But online wallets and mobile wallets are not always the safest as there is the possibility of them getting hacked into, and waiting times to get verified can take a while. The quality of customer support for crypto exchanges are not encouraging too.

Singaporean startup, NuMoney, provides an alternative to these exchanges, and wants to simplify the trading of cryptocurrency so anyone can own a Bitcoin or Ethereum or Litecoin – you get it.

Problems With Buying Cryptocurrency In APAC

Founder Steven Goh / Image Credit: NuMoney

NuMoney is founded by Steven Goh (31) and Bach Le (27) who started Nubela Corp together in August 2014.

Steven graduated from the National University of Singapore (NUS) with a degree in Computer Science and started learning programming since he was 14.

His entrepreneurial journey had begun more than five years ago as he tried to “out-Google Google” with a lifestyle app for food and activities that leverages off HungryGoWhere and Yelp.

Bach holds a degree in Communication and Media from NUS, and started out as a game developer then went into networking and distributed systems.

He has worked and built other products on Nubela together with Steven, and now, NuMoney.

The founders noticed that banks in the region have been shutting down accounts of local crypto exchanges in the region, and cited Luno, Malaysia’s most popular exchange, as one of them that had their bank accounts frozen.

As local exchanges shut down, that means there is little to almost no access to customer support – and it is extremely frustrating when you need help but there’s no one there to give you answers.

Another problem they found was the extra costs incurred by customers when they want to cash out their cryptocurrencies from exchanges.

Indonesia’s leading exchange, bitcoin.co.id, “charges a high withdrawal fee of 1% for withdrawals larger than Rp 250,000,000″, according to them.

They also highlighted the long verification times with foreign exchanges like Gemini and Bittrex, stating that a “successful verification for a Gemini account can take up to a month”.

That’s a long time in the cryptocurrency world because no cryptocurrency is going to wait for you.

So, say you missed the chance to buy a cryptocurrency at a good price and you want to take a chance on smaller altcoins. After doing some research, you find out that the exchange you are using does not support those altcoins.

Signing up or switching to another exchange like Binance is troublesome and “expensive as exchanges charge high withdrawal fees”, they said.

The Region’s First Crypto Exchange With Retail Stores

Staff serving a customer / Image Credit: NuMoney

Steven and Bach’s solution to all of these cumbersome problems was NuMoney.

NuMoney first started out as an over-the-counter (OTC) service for people to buy cryptocurrency “instantly” with fiat currency.

They sell cryptocurrency at a spread and also charge a small fee to cover the cost of the network transfer fee of the coin during the transaction.

But most customers are “happy to pay extra to receive technical support”, good customer service, and the immediacy of the service, according to them.

So, how do you get cryptocurrency at NuMoney?

Customers book an appointment, head to any NuMoney offices, pay with either cash or through internet bank transfer, and show their IC or passport for verification purposes – and done.

NuMoney’s office in Tai Seng / Image Credit: NuMoney

Their office in Tai Seng is currently operational, and the other office at Raffles Place is due to be ready in 2018.

Their business model was straightforward: obtain a cryptocurrency liquidity provider, get funding via wire transfers, and resell cryptocurrency at a spread.

In their first two months of operations in November 2017, they crossed S$1.2 million in turnover, then S$2.5 milllion just last month.

The NuMoney Initial Exchange Offering

But rapid growth isn’t always a good thing.

Problems with banks and liquidity providers started to arise because of the rapid movements of the high volume of cash.

They believed it was necessary to build an independent crypto exchange themselves if they do not want to fail.

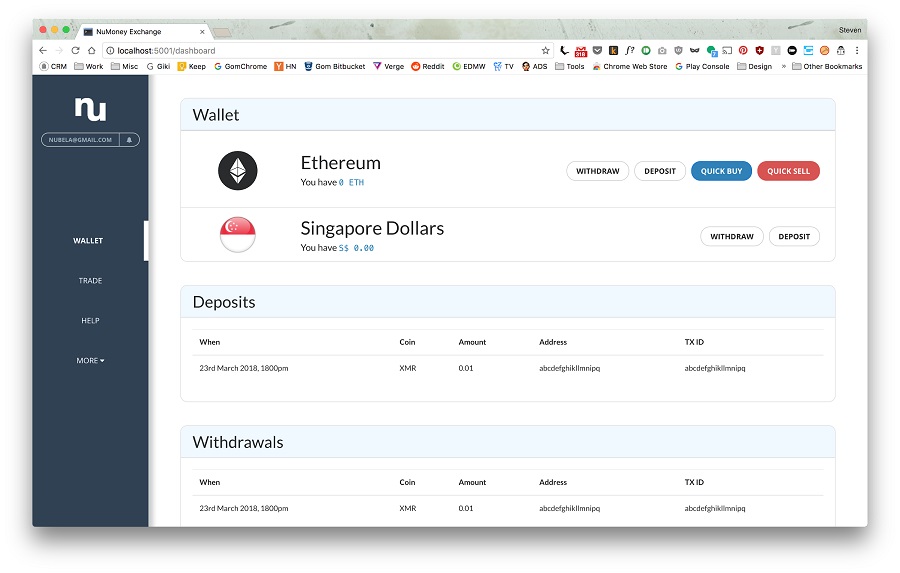

NuMoney’s exchange UI / Image Credit: NuMoney

As they explained, “The building of an exchange is imperative as it allows fiat currency to cycle within an exchange without having to cross borders, which in turn reduces the need of a banking intermediary.”

In the long run, this removes the reliance on banks and external liquidity providers.

NuMoney accepts fiat money and lets customers withdraw fiat money without going through any actual banks as they store cash deposits in cash vaults just like a bank.

This allows them to stay operational even if banks decide to shut down their bank accounts.

They explained that an Initial Exchange Offering (IEO) is a means of raising capital for new startups, and NuMoney’s IEO will let users exchange any crypto of their choice or fiat currency (like Singapore dollars) for NMX tokens minted by NuMoney.

Users can use NMX tokens to pay for transactional fees on the exchange and as an incentive, users get close to 70 per cent discount when they buy or use it.

The purpose of their exchange is to make it easier for the “average Joe who wants to get his/her hands on some cryptocurrency” using fiat currency and vice-versa.

Their conviction: by participating in NuMoney’s IEO, you are backing their exchange which is a “ready-made product” and not an “idea”.

NuMoney is confident that NMX tokens “will appreciate in value” after the launch of the IEO as users trade the tokens on the NuMoney exchange.

Their exchange is launched today, 6 April.

NuMoney’s Future Plans

NuMoney’s entrance to their office / Image Credit: NuMoney

So, with the launch of their IEO due soon, how do potential and existing customers shop for cryptocurrency when that time comes?

First, the customer will arrive at a NuMoney retail store and do a Know Your Money/Anti-Money Laundering (KYC/AML) registration.

Then they’ll have a choice to either buy or sell cryptocurrency through the OTC service or through the NuMoney exchange.

With the OTC service, the customer will have a dedicated NuMoney staff to handle the process of trading, but at a “slightly higher premium”.

If customers choose to trade with NuMoney’s exchange, they can do it at their own time after signing up for an account. Customers deposit cash with NuMoney and credits will be deposited into their accounts.

They are looking to support as many altcoins as possible, saying, “We will explore the option to open up a platform for coin founders/owners to list on our exchange without much hassle.”

The NuMoney Malaysia and Indonesia partners / Image Credit: NuMoney

Right now, they are setting up stores across Southeast Asia, concurrently launching NuMoney Malaysia in Kuala Lumpur, and NuMoney Indonesia in Jakarta.

“Having physical outlets instills trust and gives access to cryptocurrency to the general public which is crucial for cryptocurrency to go mainstream,” they explained.

Using cryptocurrency to make payments and remittance are some of the future services they want to provide to customers.

“Given our position as an international exchange, it opens up opportunities like such. Down the road I see ourselves becoming an ‘international consumer bank backed by cryptocurrency,” Steven shared.

Join the NuMoney exchange Telegram chat here to get updates on the IEO and participate in discussions on anything cryptocurrency. For more information on NuMoney, visit their website here, and the exchange here.

This article is written in collaboration with NuMoney.

Featured Image Credit: NuMoney

2 Comments

You doubt, I earn😛

You watch, I earn😝

You are thinking, I still earn😆

You don’t want to join, I keep earning 😋

You decide, I continue earning

You join, we both earn😁🏆😜

Do you have 00 in your blockchain wallet?

You can make $500 in just 24hrs

Inbox me for directions or

Contact the investment advisor via WhatsApp +(44)7480-739324

<<<<<<<<<<<<<>>

I am sure they could also help on what should CRM providers do to expand the market since there are lots traders that struggle on this thing.