Being a resident of one of the most luxurious and technologically advanced cities in the globe certainly has its perks. You earn a lot of money and can afford fantastic holidays twice a year, you sit in the first row to see the world changing and financially – you’re on top of the world. But from time to time, a devastating thought comes to mind – am I spending too much money? What am I even doing here? This usually happens when some unexpected expenses occur.

How do you make sure, then, that you always have some money saved for the rainy day? Here are top sensible pieces of advice you can hope for and which you can implement TODAY. No more of ‘I don’t have time/I can’t afford it/I can’t do it’.

Put your credit card to a better use

A credit card can be your best friend and your worst enemy. Nowadays, the issuers provide their customers with various benefits, which can be used every day to accrue savings. With wine and dine promotions you can often get 1-for-1 offers, where every second person in your party eats for free. Grocery shopping often gets you up to 8% rebate. Also, pay off your debts on time. It’s much easier to save when you don’t have a big bad sum of money hanging over your head.

Try to cook more at home

No one is trying to convince you that you shouldn’t go out to meet with friends for dinner. Besides, lack of time forces us to buy food from eating outlets. However, for the price of a meal at a restaurant, you can have at least three home-cooked of the same (or even better) quality and value. Can’t cook? Internet is full of recipes.

Shop on sales

Not every sale is a true bargain. You need to become a bit savvier is you want to use promotions to your fullest advantage. Need some examples? Use reliable sources when it comes to shopping for clothes and accessories, those which provide you with only the most valid and up-to-date offers. With a discount code website, Picodi, which is available on your mobile too, you can see all the vouchers in one place and compare them instantly. You’ll know whether that dress has actually been discounted or is it just the store’s marketing trick.

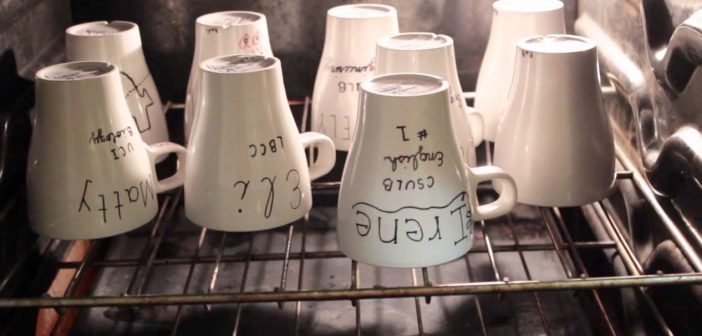

Have a cuppa the right way.

Fan of cup of Joe? Have it your way but use your own cup instead of disposable ones, provided by coffee shops. Some of them offer you a discount if only you bring your own mug or take-away cup. If you have at least one coffee a day and you get a dollar on each portion of coffee, you’ll save at least $350 a year. You can also invest in the right coffee machine if you’re truly passionate about the black gold. Sure, you’ll have to pay more upfront, but it’s one of the things you can treat as more of an investment, not an expense.

Recycle with the number THREE

Be serious about your wardrobe. Take the active approach, and check which clothes have been sitting in your closet for too long. If you haven’t worn something for three years, it means you are not meant for each other. Many clothing chains offer you vouchers for each bag of unwanted textiles, so that you can get rid of the things you don’t want anymore, and save on your next shopping session.

Be critical towards your expectations

If you can’t afford to pay your rent in that particular area, don’t live there. It’s really that simple. Take a piece of paper and check if living somewhere else and doing the commute wouldn’t cost you less. Also, why don’t you want to drive a more expensive car? As long as it’s good quality, it still has four wheels, a clutch pedal it’s just the same as those fancier ones.

Take care of your health upfront

It’s much cheaper to eat well and healthily than to receive treatment at the doctor’s. In the long run, an illness can cause you time off work, unnecessary stress, further problems in your job. By having a diet rich in nutrients and vitamins, you’re doing a lot of the work yourself. Losing your insurance due to lack of work can be costly both in money and in your life.

Don’t use gyms if you can’t afford them

If you really want to sweat, you don’t need to pay for it. Having money means managing it responsibly and when you think of it, you can go running outside, rather than doing it in a closed, air-conditioned room with other people. Push-ups, sit-ups? Your own carpet is just as good. Need some weightlifting exercises? Buy weights or use home objects to build your muscles.

As you can see, it doesn’t take a genius to save money on a daily basis. All you need is a piece of paper, a pen and a critical look at your life. It’s difficult, it’s nerve-wracking (why should I stop being who I really am!), but it pays off. In more ways than you could expect.

2 Comments

Great article! I also use promo codes frequently to save extra on my online purchases. Some websites i use inlcude https://kiasupromos.com, Picodi and Saleduck. all awesome coupon sites 🙂

Something is new for me, I read it and gain a lot of information. Thanks