Investment-Linked Insurance policies (ILPs), are a special breed of policies with both life-insurance and investment components. The premiums you pay for these policies are mainly used to purchase units in investment subfunds, which would yield the typical investment gains. The fundamental benefit would be gaining a certain percentage of those sub-units sold to pay for insurance coverage.

If you are unfamiliar about all the various kinds of investment portfolios available, you would find that there are numerous forms of investment options that include bonds, stocks and mutual funds. ILPs offer investments portfolios similar to these traditional forms from the biggest companies in your country and even internationally, all while providing insurance benefits at the same time.

If you want to purchase more sub-units, which would then lead to a greater insurance coverage, you could do so. With ILPs, you would see more sub-units going towards investments as well, if you pay more in premiums. In fact, there is even an explicit option that allows you customisability on your investment mix and insurance coverage depending on your financial situation. You may put in more money into your investments, make withdrawals or change sub-units so as to create a more successful portfolio with better returns.

This is why the various categories of ILPs are essential to know: you need to know exactly what you are getting with insurance policies like these. What’s equally noteworthy is that you have the option to view these ILPs as equivalents of traditional insurance policies, but with additional investment elements. For example, premium holidays, special occasions when you are exempted from paying premiums but still allowed to maintain the policy, is a overriding feature that runs across both ILPs and traditional insurance.

Two main categories of investment-linked insurance are:

Single Premium ILPs – A one-shot big payment used towards buying units in sub-funds. Typically, these offer lower insurance coverage than regular premium ILPs.

Regular Premium ILPs – You pay premiums on an on-going basis, while adjusting your insurance coverage on the go.

At first look, you would see that ILPs are an, easily customisable inroad into actual insurance for the mass majority of people. You can choose to pay a one-time lump-sum premium if you want make some small investment efforts, or you could branch into more sub-units, while having a bigger insurance ‘umbrella’ over you.

But, one thing to note about ILPs would be the risk. You always bear the entire investment risk with Investment-linked insurance. Your financial planner usually is more than capable of helping you choose the right combination of investment-linked funds so as to fit your risk profile and investment objectives. If you’re the brave type, he’d likely suggest something that has potential to bring higher returns but holds more risk potential. If you’re prudent, he would then propose a safer choice for you.

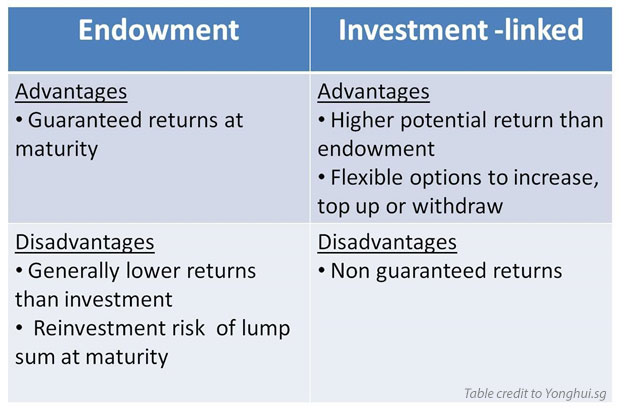

When it comes to traditional whole-life, endowment and term plans, you do bear a little bit of risk on guaranteed benefits from the fund involved, which depends only on its singular investment performance. But these risks do not stem from investment market tracking. Most of the bonuses in conventional plans are actually guaranteed and vested by the insurer instead.

It is easy to see, that even if ILPs are flexible endeavours to get into, you won’t be experiencing the same guaranteed bonuses like you would more traditional plans. Also, you are also not likely to be seeing whole-life insurance offered in your investment-linked insurance plan, as the premiums are often paid as a lump-sum or as installment payments that are not easily accommodated long into one’s older years. For life insurance coverage, you certainly shouldn’t be exploring ILPs.

Instead, it is more feasible for working professionals and the more nimble, ILPs are an attractive way to bring together investment ambitions (and higher returns) with possibly short-term insurance coverage. It would be perfect for the young to middle-aged working professional wanting to make their money work to supplement their day jobs. The pace is always set by you.

Furthermore, buying excessive insurance can be an expensive act, and not buying enough can bring your family a lot of stress. Understanding how much coverage you need exactly is indeed important. This is why Investment-Linked Insurance plans offer a better way to test the waters should you be unsure of just how coverage you need, while getting returns. You could be avoiding student debt with ILPs.

If you are less concerned about the returns and more about your health coverage, a life-policy is recommended. Although you are getting death or total, permanent disability coverages with ILPs too, the coverage amount would be far smaller than those of typical life insurance policies, as they are limited by the amount of sub-units purchased.

All in all, with the added ability to track investments with yearly statements, you can rest assured that Investment-Linked Insurance Plans are a great way to get more financial returns with your coverage.

Author Bio

Jeremy is a regular contributor to Call Levels, the world’s first free stock monitoring app, and the Call Levels blog.