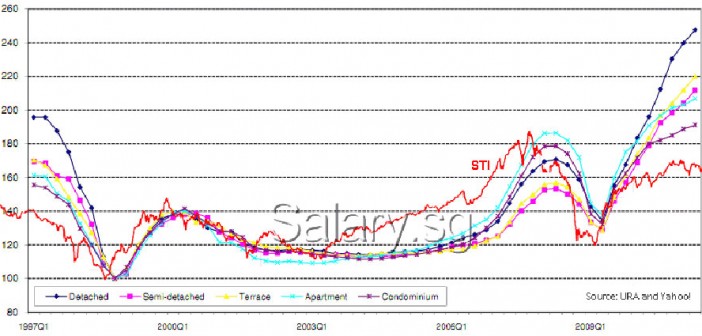

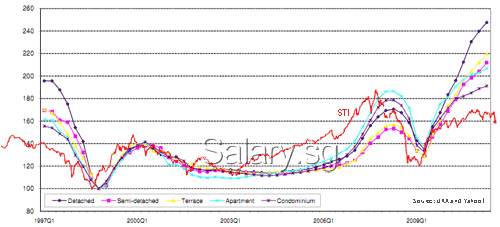

The URA property price index is at a historical high.

While the stock markets around the world are turning bearish, it is still anyone’s guess as to whether the Singapore property market is heading for a crash.

To argue against a crash, property bulls will cite the extremely low mortgage interest rates offered by the banks here, a possible QE3 by the US Federal Reserve, and the hot money that is still flooding into the region.

Salary.sg made a prediction 3 years ago, which proved to be correct. What we did was simply to superimpose the Straits Times Index (stock market) chart over the URA property index graph, and let the combined chart tell the story.

We do it again this time (click to see a larger chart):

11 Comments

Even if we grant that history is of any indication, from your graphs, it is apparent that there’s still about 4 to 5 quarters (1 year+) before the condo market peaked out. And 1 year is a long time in today’s context!

Agree with John. A crash will not be so soon. Generally, the property market lags the stock markets by 2-3 quarters. Perhaps now is a good chance to position oneself.

Yep, it’s hard to say, however there is no chart that can tell you what will happen if Europe implodes tomorrow or next month, but mind you, it’s guaranteed to implode, it’s just a matter of when.

I am actually more interested on why the government has not increased interest rate so far. Is it because most local players will be hit hard?

On Europe imploding – The market can remain irrational longer than most people can insist on holding cash and resist the lure.

On low interest rate – it’s all because of the tons of cheap money printed by Ben.

Past performance is never an indication of future returns. 🙂 I had to say that.

Also, there is an interesting statistic you have to factor in. I suggest reading this article that indicates that property prices today are actually near fair value taking into account rental vs. price. While it is bad to put too much faith on a single number… I would appreciate if anybody could post the correlation between rentals vs. prices.

The property prices will never go down if Singapore continue to import FT like eating chicken rice.

Minister’s pay is pegged to GDP, so having higher population equals higher GDP.

Higher population requires more housing but there is a real shortage and rich people want to see their existing property prices to rise. Ministers are all rich land / home owners… so the conflict of interest is there.

Homes in Singapore are no longer affordable for the average Singaporeans. 90% is due to government policy. If the government really wants, they have enough land to build another 100K flats, but do they really want to do so?!!

hahaha, with so much money printed by FED and singapore gov, who is short of millions. Our minister make them in a month. What to do with those paper?? I can sell my apartment for a million worthless paper which is being printed by the billion as i speak. Where am i going to put my million after selling????

I am having trouble putting away my cash million earning zero interest in DBS. Anybody any ideas??

Property Crash Coming? (See Graph) | Salary.sg – Your Salary in Singapore – just great!

There is no point keep money in the bank with so low interest rates, with talk of hyperflation and the US debt unwinding.

Many consider property a safe haven. At least I do.

This makes for the latent demand for property which is not reflected in STI.

IMHO, market prices are sustained by this demand and it has to be factored in to consider if a bubble is forming.

Excelplent blog! Do you have any recommendations for aspiring writers?

I’m planning to start my own site soon but I’m a little lokst on everything.

Would you recommend starting with a free platform like WordPress or go for

a paid option? There are so many options out there that I’m totally overwhelmed ..

Any ideas? Many thanks!

A good strategy here should be to value bet if you live drawing to the fourth

round since you possess a strong starting hand

plus you may well be drawing into a level lower one.

Of special note is the fact that successful hands are valued very differently from a usual poker version.

What this means is always that the buy looking for any specific tournament must not exceed %3 of one’s bankroll.