$52,350 is the median income of all resident taxpayers for YA2008, which I calculated based on the numbers in IRAS annual reports.

You can use this income comparison tool to see which percentile you belong to.

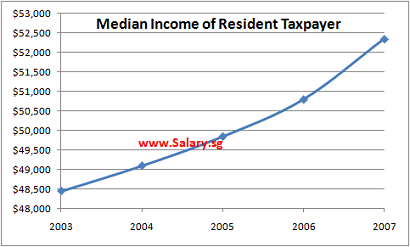

However, the main objective of this article is to show how much the median income has grown over the years, as inspired by the Singapore Budget Speech 2010 (more on this later).

For YA2004, which assessed your income earned in 2003, the median assessable income of all resident taxpayers was $48,450.

This grew to $49,100 in 2004, then to $49,850 in 2005. It subsequently increased to $50,800 in 2006, and finally to $52,350 in 2007 (i.e. YA2008).

Over the 5 years from 2003 to 2007, the median income grew by about 2% per year on average. The figure for 2007 is about 8% higher than that for 2003.

However, in the Budget Speech 2010 given by Finance Minister Tharman Shanmugaratnam, the “median income” apparently grew at a faster rate, from an index value of 103 for 2003 to 116 for 2007. This is a 12.6% increase.

What gives?

Note that Mr Tharman uses median income per Singaporean household member. Further, as stated in a footnote, the data “refers to non-retiree Singaporean households” and “excludes households consisting solely of non-working persons over 60.”

As an aside, we do not know if “Singaporean households” refer to households consisting of purely Singapore citizens, or a mix of citizens and PRs. To me, it is technically correct either way. Let me know if you think otherwise.

Without more details, we can only make educated guesses.

First, household sizes may have decreased over the years. Besides falling birth rates, we also have more foreigners arriving here to work. I do not think the typical foreigner brings along many dependents here. Perhaps Mr Tharman can also provide a corresponding chart that shows the median household sizes over the years.

Second, is there a special reason to exclude retiree households? We know that Singapore has an ageing population and that many baby boomers are now entering retirement. Many of these retirees depend on somebody else’s income to get by. It will be good if Mr Tharman can provide an additional chart to show the number of retiree households over the years.

Anyway.

Was your income in 2007 (or YA2008) more than $52,350?

41 Comments

Pingback: Do You Earn More Than $52,350 – The Median Annual Income? (salary.sg)

don’t be upset by the report , $52,350 is the average income of those who are paying tax including the millionaires but excludes many many people whom are not taxable.

not avg but middle, meening that if you ranked salaries of all tax payers from richest to poorest from 1 to 999,999 then 52350 is no. 500,000…ok i feel depressed already

ek888, do you know the difference between median and average?

If you use the average, it will be skewed by the big numbers, but if you use the median, the skewing effect is effectively not there- hence giving a better way to do comparisons.

Example: the average of 1,2,3,4,5000 is 1002 but the median of the same five numbers is 3!

so you see, Mr Mah is correct. HDB is affordable! a 400k flat is about 8 times annual income. (50k S$) If you save 30$ of your income, it takes about 24 years or less to pay for the flat.

I’m 23, my gf is 22, and we have combined salary of S$ 114,000 per annum… hmmm… but the graph doesn’t include the ages of the taxable tax-payers though… darn…

so young and already making so much? are you guys self-employed?

Hi curious,

we’re working in foreign banks in Singapore.

it’s not exactly ‘much’, as compared to the people who started earlier and enjoyed the peak in 2007, but i guess it’s sufficient for both of us to save up, pay back our study loans, and work towards wedding and beyond.

wow, young people now earning so high, no wonder property prices have been going up and up in recent years

young and earning so much!

21 + 23 so young means both of you dont even have a degree. what study loan to talk about? poly? diploma in a foreign earning $114,000 combined is pretty incredible 😉

Hi Vote for SGP instead of SIN for Singapore Says,

Would you know how much a product specialist can make in a foreign bank?

It’s not how much you earn, it’s how much you KEEP!

Hello Curious,

As of 2010 intake, I could say that fresh grads entering Product Control of bank’s operations department are earning around 40-50k per annum, thus, for a ‘specialist’, that would take 3-5 years to reach that position. I’d say around 70-100k generically, depending on one’s performance.

@ dispel:

My gf (22 y.o., not 21) has a first class honours in B.Sc. Economics.

IFor myself (23), I have a Bachelor of Engineering.

Have I answered your question?

Hi Vote for SGP instead of SIN for Singapore Says,

Wow… 70- 100k for 3-5 years experience … is bonus included? If not, what would typical bonus be?

For Singapore university, the youngest age one can graduate is for a girl to enroll in 3-year Nanyang Business School for direct honours.

However, in my gf’s case, she had her A Levels since 17, and she went on to the UK to enroll in economics which is a 3-year course for direct honours as well.

In fact, in America, age isn’t a concern at all, as long as we have the right qualification. A junior of mine had obtained her B.Sc. Biomedical Science at the age of 18, and she is now enrolled into a medical school, at the age of 19. It’s not surprising, really.

@Dispel, broaden up your mind. Age ‘limit’ or ‘at this age u can’t possibly have a degree’ mentality is not exactly applicable.

@Curious: No, that figure doesn’t include bonus.

Regarding ‘typical’ bonus, it highly depends on individual performance indicator, as well as the company’s overall performance for that financial year.

Some may not even receive bonuses. However, typically, 1-3 months’ worth is the amount with most people would receive this year, after 2008-2009 catastrophe. However, that’s for finance sector.

For oil&gas industry, I have friends who receive 6-8 months’ worth.

Hi Vote for SGP instead of SIN for Singapore Says,

I see – what is the career path after 5 years for a product specialist then… are prospects good for furtherment of career (senior product specialist?)? How long can someone stay as product specialist before they kick you out for being too old…

analyst -> associate -> assistant manager -> manager -> assistant v.p. -> v.p. -> vice director -> director

generally this is the career path in financial industry (at least 7-8 steps to the top, each step require 2-5 years to overcome)

the product specialist we talked about possibly can be referred to as an associate, in terms of corporate title.

In my opinion, the keyword is ‘relevance’. As long as our skills are updated and relevant to the company and the industry, through various means of traning that the company provides, I don’t think anyone would be kicked out for being ‘too old’, but rather, for being ‘irrelevant’.

so many levels! but now i know why they say finance industry pay so well…

associate level already earn 70k-100k (excluding 3-4 months bonus)..think by the time a person hits v.p., package probably doubles!

I thought Asst VP comes under branch/dept manager…

that was ‘generic’

corporate title ladder differs from commercial bank

to investment bank to private bank to boutique bank =)

bunch of Bullcrap survey and answers..most inaccurate crap ever..

Still dunno why an investment banker is not included in the list of occupations of the MOM. Does any one know?

maybe some of them are called “managing directors”?

just enjoy your work and life…money is important but not all…. …..

………………………….

there is always 1 better and 1 worse…

Does the median income include transport allowance?

My annual income is definetly way below this amount. However, I must stressed that I am not a degree holder.

woot i am just over the median not including my bonuses. 30 yrs old in banking.

don’t study engineering. The worst and usefless job in Singapore context. Work like dog and pay peanuts.

Whats the big deal here about two twenty something earning barely 100k, do you guys need to bombard them with so much questions. If you doesnt measure up, just work towards it.

if it serve any purpose. i am 30 years old, retired at 27, worth 4m USD. Now earning 800k per annum trading my own money. And yes, i dun need to empahise i have a first class Hons, because it doesnt count for shit. you are not going to make more money even if you have a PhD.

tsk tsk…who gives a shit about median income

Kong: does your given name happen to be Hee?

wahahahahahahahaha!!

Kong Hee is not 30 years old now.

At this age, it’s either you had a rich parents or grandparents to have the capital to do trading.

Looks like oil and gas and finance are still the lucrative industry

u gona be kidding me…all the facts about singapore are lies, singapore is clean? lie..singapore is the second richest country in asia after japan? lie, singapore have GDP per capital that matching australia? lie..looks the job ads, 2k 3k 4k a month? do u know how much new zealand earned? do you know what are they start salary? 40k 50k is consider as started pay..while singaporen are still earn 30k be happy drop tears..poor singapore and people who lives here.

so.. how much do you earn? talk so much huh

kidding is kidding.. that’s why choose that user id.

“$52,350 is the median income of all resident taxpayers for YA2008, which I calculated based on the numbers in IRAS annual reports.”

I haven’t the opportunity to browse the latest IRAS report, but I think everyone should read the above line and interpret carefully: there are many (in the significant double digit of households I would bet my last dollar, which is a small handful of hundred dollars) households who earn less than the income tax threshold. They are therefore non-taxpayers. So the actual median household income would be far lower than $5k. This is not the true picture of the typical singapore household

the blogger is technically correct. he did say “all resident taxpayers”. i’ve been following this blog (cos it interests me) and i must say he almost always excludes people at the bottom – the blue collars, those who don’t pay tax, etc. though “unfair”, it’s a way to so called “pit against the best”. why compare with the worst? while we understand the need for social safety nets and such (another theme for another blog), the “unfair” comparisons here sort of spur us on to better ourselves (i assume you and i are working professionals who look forward to earn the best income we can earn, otherwise you won’t be visiting this blog).

The median income translates into a average monthly income of $4,300,which also translates into a take home pay of approximately $3,300. Money already not enough but apparently singaporeans still not very concerned about retirement planning and taking actions to prepare themselves financially for it. Very interesting phenomenon. Really expecting the government to forever support u?