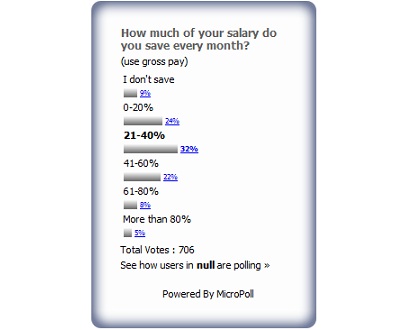

We conducted a poll on how much Salary.sg readers save. The results of the poll show that the average saving rate of our readers is 33.1%.

The average Salary.sg saves about one-third of his/her monthly salary.

The poll attracted more than 700 responses, 32% of which picked 21-40% as their saving rate.

Another interesting finding is that about a third of the respondents either don’t save or have a rather low saving rate of between 0 to 20%. (In the western world, a 10% saving rate is recommended, but I’m sure most of us wouldn’t be comfortable with that.)

16 Comments

30% on top of the CPF?

Wow, I am impressed; that’s a lot of sacrifice for the children

Looking at the comments here it does seems like there are a lot of high fliers following this website.

When salaries are high usually you can save a much higher percentage of it unless you over indulge in luxuries.

It is very comforting to know that many people in Singapore are doing very well and managing money wisely.

We should sail past this recession quite peacefully.

If you earn 150K, spending 70% (saving 30%) mean spending 8.75K a month. So saving 30% is nothing with high salaries.

Meh. It’s not impressive, it’s just about managing your expenditures!!! Even when I was earning 3000/month so many years ago I could consistently save about 40-50%.

As my income increases, my saving percentage increases as well. These days I think I live quite well and can save consistently 50-60%.

It’s just managing spending so it doesn’t grow as fast as income, that’s all. For instance I don’t have a car, I take public transport. But a lot of my friends who earn less than half of what I get are driving cars already. So obviously their saving is not as big lor.

BTW admin, thank you very much for implementing the linebreaks! Now paragraphs can be visually separated from one another, thanks a lot for that!

I am just wondering what people are saving for

What it their goal?: live like a student from 20 to 65 in order to have a nice retirement from 65 to 76?

Charles: I can’t say for others, but my target retirement age is 45. I think it’s a bit useless to have a nice retirement at 65–what if you die at 66?

(Of course you can ask also what if you die at 27… but I think we have to take a sensible middle ground here lah)

And as for why people are saving, there are 2 main reasons:

1. To be prepared for emergencies (losing jobs, getting fired, etc.)

2. To have your money work for you!

Goodie: would love to see your yearly budget

Hi Charles, I don’t keep a very detailed budget. What I do is that every month by default 50% of my take home goes to savings and investments. And after that usually I still have some extra, which then I’ll put into either of those 2 (savings or investments).

I would estimate my expenses to be around 5k/month. Sometimes more, sometimes less.

Hi Goodie, which confirms what goes around when people are coming to Singapore: S$10k salary is required, which is sooo much higher than the median salaray

Hardly… remember that I said I was saving 50% of my income even when I just started working taking in 3k/month.

> $10k is “required” only if somebody wants to do it the way I do it… but again as I said, I have a number of friends who take home much less than I do and still spend way more than I do (very frequent overseas trips, having a car, eating in very expensive restaurants, etc.)

So no, not required to have > 10k salary if what you want is just a car (which I don’t have), or travelling abroad every 2 months (which I don’t do)…

When I am 25, I save 25% of my $1500 take home salary. Now I am 34, I am saving 34% of my $4800 take home salary.

when I am 50 yrs old, I will save 50%… When I am 60, I will save 60% of my Income if i am still working. Good idea or not?

Might be difficult to implement leh. What if at 50 your income is less than your income now? Your plan is based on the assumption that your income will keep rising and rising. I do hope that it will be the case for you, but just recognize that there’s a possibility it might not happen.

that’s a lot of sacrifice the children r making !!

In Asia, basically we don’t have any social welfare partially maybe our income tax is quite low, so we cannot just save 10% like in western countries, and I feel that we should save 1/4 to 1/3, and I always save more than that %…. (Most of CPF has been used in house, so the saving % is on top of CPF)